Qlower has prepared a simple and effective guide to help you complete the 751-SD form for your LMNP (Non-Professional Furnished Rental) activity questionnaire in 2025.

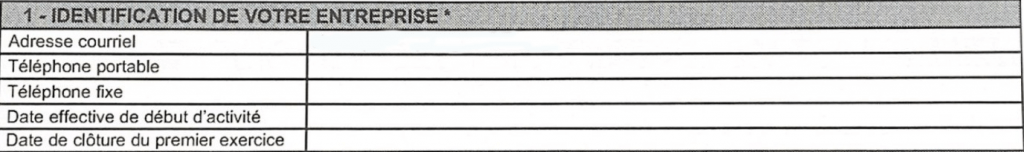

After submitting your declaration of activity as an LMNP via the P0i or P2P4i form (for additions or modifications), you will receive your SIRET number from INSEE.

At the same time, or shortly thereafter, the Business Tax Service (SIE) will send you a “Professional Activity Questionnaire” or form 751-SD, requesting additional information to determine the CFE (Corporate Property Tax) amount owed by all LMNPs starting from the second year (subject to conditions).

The 751-SD form is a document automatically sent by the tax administration once you have registered your LMNP activity.

The 751-SD form, or “Professional Activity Questionnaire,” is used to collect fiscal and administrative information about a professional activity. It is required when creating, modifying, or ceasing an activity and helps identify the applicable tax regime (VAT, income tax, etc.).

The 751-SD form must be sent primarily when creating, modifying, or ceasing a professional activity. Specifically, it applies in the following situations:

Cessation of activity: When you permanently cease your LMNP activity.

The form can be submitted in several ways, depending on your situation and preferred method of communication with the administration:

Example:

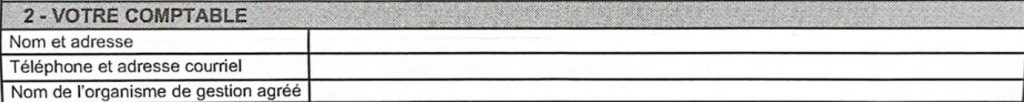

If you handle your own accounting (with Qlower as your assistant), leave this section blank.

If you are affiliated with an Approved Management Center (OGA), include its details here. Otherwise, leave it empty.

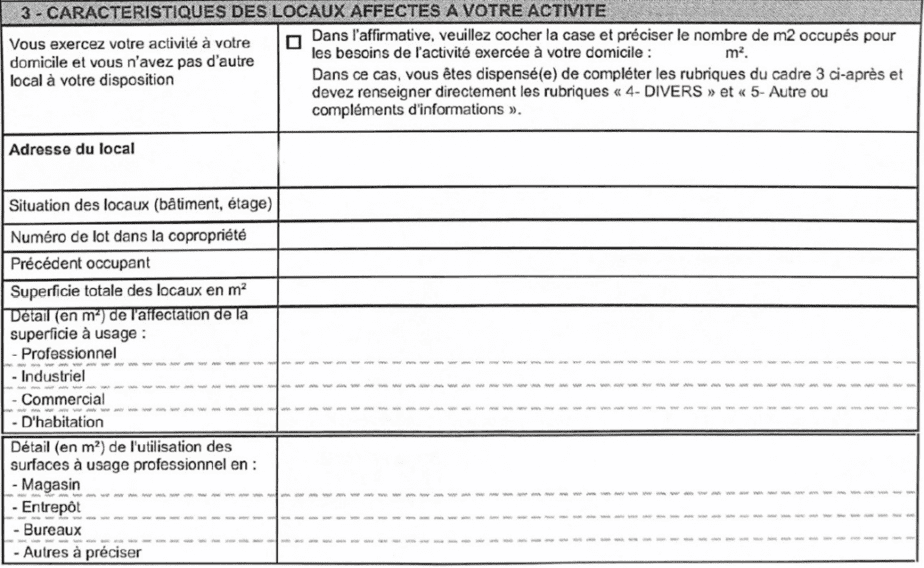

If you carry out your furnished rental activity at your residence—for example, renting out your home while you’re away (e.g., short-term rental) or renting out part of it (e.g., a room for a student)—you must check the box and indicate the number of square meters used for the rental.

In the first example, this will be the total area of the apartment; in the second, the area of the rented room.

If you do not conduct your furnished rental activity at your residence, do not check the box and instead directly provide the following details, which are usually in your possession:

In the case of a furnished rental, the entire surface is dedicated to residential use. Therefore, transfer the “total area in m²” to the “Residential” line and enter 0 m² for the “Professional,” “Industrial,” and “Commercial” lines.

No professional use needs to be reported in the section dedicated to “areas for professional use.”

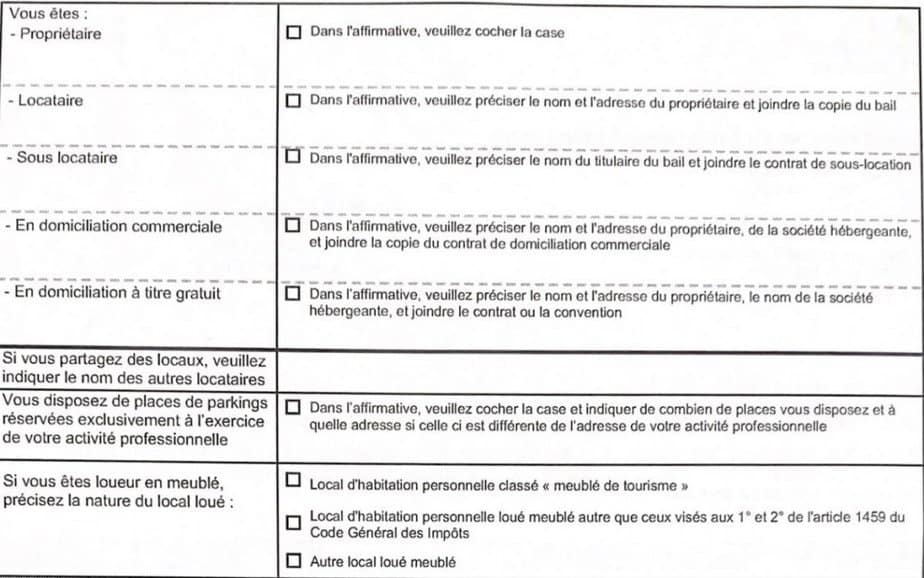

Check the “Owner” box.

Indicate if you also rent out parking spaces.

Personal residential property classified as “Tourist Furnished Accommodation”: if you own a guesthouse with tourism services (e.g., laundry, breakfast).

Personal residential property rented furnished other than those covered under points 1 and 2 of Article 1459 of the General Tax Code: for a “classic” furnished rental property.

Other property rented furnished: in all other scenarios.

On the line “If you are a furnished rental owner, specify the type of property rented,” only check the boxes in the following cases:

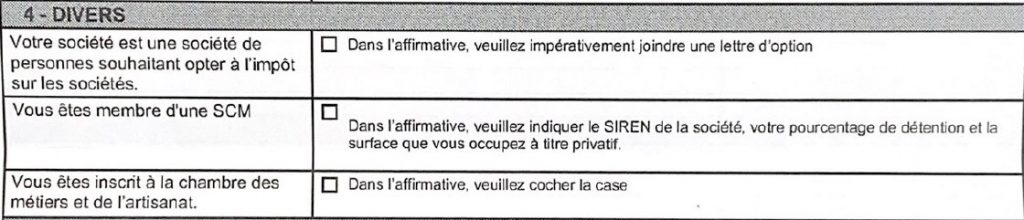

No checkboxes need to be filled out for standard LMNP activities.

Include the following mention:

“Apartment intended for Non-Professional Furnished Rental.”

After submitting the completed questionnaire, you will receive a pre-filled 1447C-SD form, which will provide more detailed information about your activity to calculate your CFE (Corporate Property Tax).

This form is generally available on your professional account on impots.gouv.fr around November. If you do not receive it, you must complete and send it directly to your local SIE (Business Tax Service) for the rental property.

You can find your SIE address via this government service (select “Professional” then “General Tax Question” to obtain the email).

You will need your SIRET number, the P0i or P2P4i declaration, as well as information about the rental property, such as the address, surface area, and details about previous occupancy.

It is recommended to set December 31 of the current year as the closing date for your first fiscal year. This allows for standardized annual fiscal years starting from the second year, simplifying administrative management.

The CFE (Corporate Property Tax) is due from the second year of activity for all furnished rental landlords. After submitting the 751-SD form, you will receive a pre-filled 1447C-SD form to detail your activity and establish the tax calculation base.

If you don’t receive the 1447C-SD form, download it from your professional account on the impots.gouv website and submit it manually to the SIE (Business Tax Service).

Some exemptions may apply, such as if your property is located in a rural revitalization zone or if your revenue is below a certain threshold. It is advisable to check these criteria with your SIE.

You can find the address of your SIE by visiting the government website, searching for the “Business Tax Service” section, and selecting the “General Tax Questions” option.

Failing to declare the 751-SD form can lead to:

Negative impacts on your financial reputation, potentially complicating access to credit.

Qlower offers useful content (articles, tips, and more) to help you build and grow your real estate portfolio. Join the Qlower community and share your questions and feedback.

Obtenez dès maintenant tous les conseils d’experts pour vous faciliter la vie et boostez votre activité de loueur en meublé