LMNP Status Guide: Formalities to Start Your Activity in France in 2025

Guide to LMNP Status: Formalities to Start Your Activity in France in 2025 The Non-Professional Furnished Rental (LMNP) is a tax-efficient option highly appreciated by

Congratulations on owning one or more rental investments! Whether they are offered for rent unfurnished or furnished, you are required to declare your rental income each year. Qlower is your online LMNP accountant, guiding you step by step through the process for complete clarity. Let’s explain!

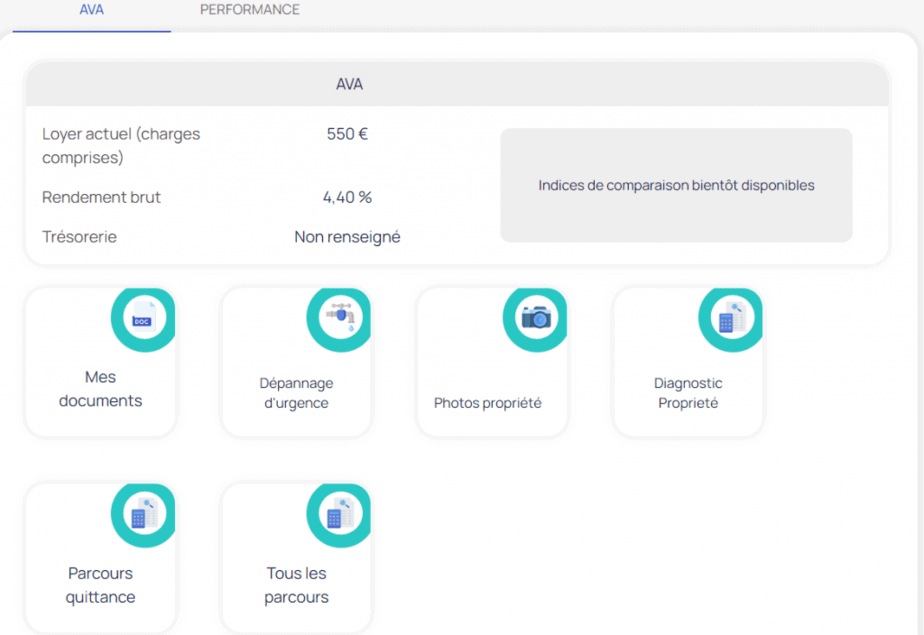

Once your account is created, you can describe your real estate portfolio property by property. Houses, apartments, parking spaces, multi-unit buildings—from the smallest to the most impressive properties—Qlower clarifies your rental activity in real-time. To do this, provide the details of each property; Qlower automatically assesses their value and market rent. Acquisition information is necessary for calculating depreciation and profitability of your properties. The more precise you are, the more accurate the calculations! This forms the basis of your accounting.

Tip: Also enter tenant details and your address; this way, Qlower automates the production of monthly receipts. 😉

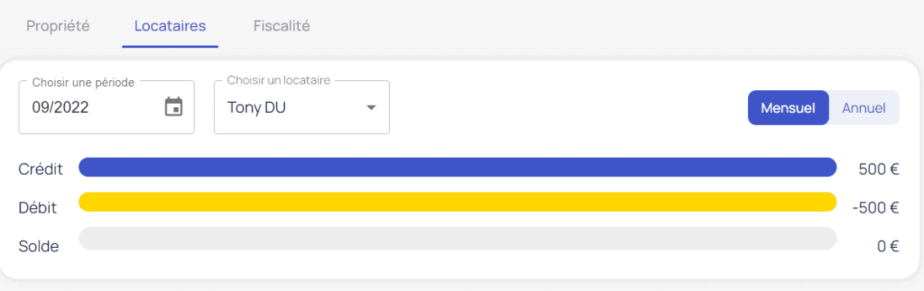

You enter, each month or each year, the flows related to your rental activity. Rents received, expenses incurred, insurance, work, furniture, equipment, loans, etc. Everything counts in non-professional furnished rentals because almost all expenses are deductible, even notary and broker fees. Qlower builds the accounting from these elements provided by you. Of course, daily checks are carried out to identify any errors or inconsistencies.

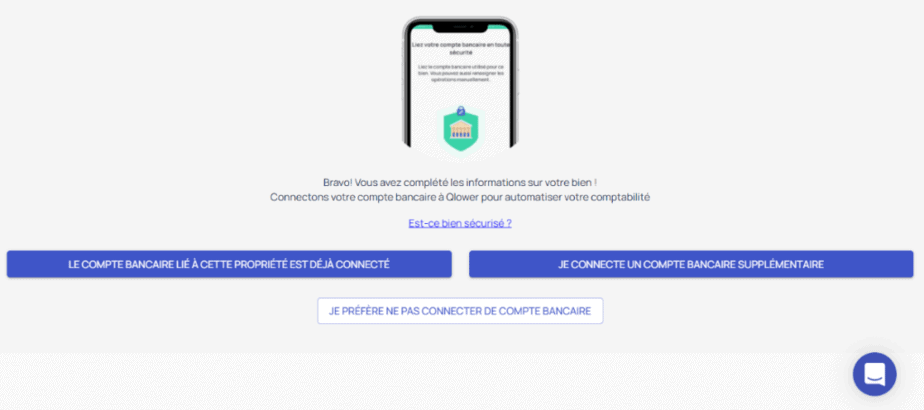

In Automatic Mode:

Everything is done automatically. Your only action is to connect your bank account and then regularly validate the retrieved transactions. It’s risk-free, as Qlower uses Open Banking technology. Simply put, Open Banking allows you to share your banking data with whomever you want, in this case, Qlower. The tool recognizes rents, loan payments, and often regular withdrawals. It’s up to you to validate rarer transactions or checks that are not automatically recognized. Transactions to be validated by you appear in “To Validate.” You can then validate them or exclude them so they are removed from your rental activity accounting.

If you pay expenses related to rentals from another bank account, you can always add these expenses manually by creating additional transactions.

Note: The 2019 Pacte law requires the creation of a bank account dedicated to rental activity from €10,000 in annual rental income.

For each transaction, ensure it is assigned to the correct property, that the correct category is indicated, and if it concerns the tenant (rent, re-invoiced charge), that the tenant is properly mentioned. This feeds the different accountings.

Qlower is an accounting tool. It maintains three accountings in parallel:

Property Accounting: Tracks income and expenses for each property. Rents, loan repayments, charges…

Tenant Accounting: Tracks rent calls and payments from each tenant. It’s from this accounting that you issue receipts and final account statements. It also works very well in shared housing.

Tax Accounting: Extracts from property accounting only taxable income and deductible expenses. For example, for a mortgage payment, only the interest and insurance will be accounted for tax purposes, not the principal repayment.

During the rental of a property, some special cases are well handled by Qlower. The entry of a new tenant, the final account statement, the recovery of the property tax on household waste (TEOM), rent revision… Qlower offers simple processes that allow you to forget nothing for your accounting. But don’t worry, our algorithms and experts watch over you and identify any omissions or inconsistencies.

Depreciation is the true advantage of the LMNP status. It allows you to deduct the wear and tear of the furnished rental property by creating a depreciation expense. This expense significantly offsets the rental income received and often eliminates the tax liability.

Qlower calculates this depreciation for you based on the information provided and verified with you by our team. For a recent purchase, the purchase value is considered. For a property purchased several years ago, whether previously occupied or rented unfurnished, the estimate you provide determines the property’s value. It is your responsibility to provide us with an honest and professional estimate.

Qlower accountants include depreciation-related transactions in your accounting records.

As you’ve seen, Qlower continuously monitors your accountings. At every moment, we detect possible anomalies (13 rents over 1 year), omissions (property tax), amount inconsistencies, typos (e.g., a TV at €5,000 in a studio rented at €400)…

Once these checks are completed, we validate with you the elements considered for the tax declaration. Everything is OK; we send the elements for the final verification.

Qlower advocates for the employment of seniors. Each tax declaration is manually verified by retired accountants who act as certifiers. They are best able to detect the last possible issues in a complex tax package.

Once this certification is done, your LMNP declaration is electronically transmitted to the tax authorities.

Once the rental income declaration is transmitted to the tax authorities, we send it to you for your records with the acknowledgment of receipt from the tax office.

It’s not the most pleasant bedtime reading. So, Qlower also sends you a brief report explaining what happened, property by property. It summarizes in simple terms the past year, the coming year, and the impact on taxes. We take the opportunity to highlight some identified opportunities if costs seem optimizable.

Qlower guides you from registering your activity to filing your tax return. The Qlower team is here to support you and answer your questions about property management, accounting, and LMNP taxation. You’ll see, investing in LMNP becomes simple when you’re well-supported.

Guide to LMNP Status: Formalities to Start Your Activity in France in 2025 The Non-Professional Furnished Rental (LMNP) is a tax-efficient option highly appreciated by

How to Declare Rental Income from a Furnished Property in France in 2025? ? If you own a furnished property for rental purposes (whether for

Sign up for the Qlower Newsletter

Qlower offers useful content (articles, tips, and more) to help you build and grow your real estate portfolio. Join the Qlower community and share your questions and feedback.

Obtenez dès maintenant tous les conseils d’experts pour vous faciliter la vie et boostez votre activité de loueur en meublé